Latest products

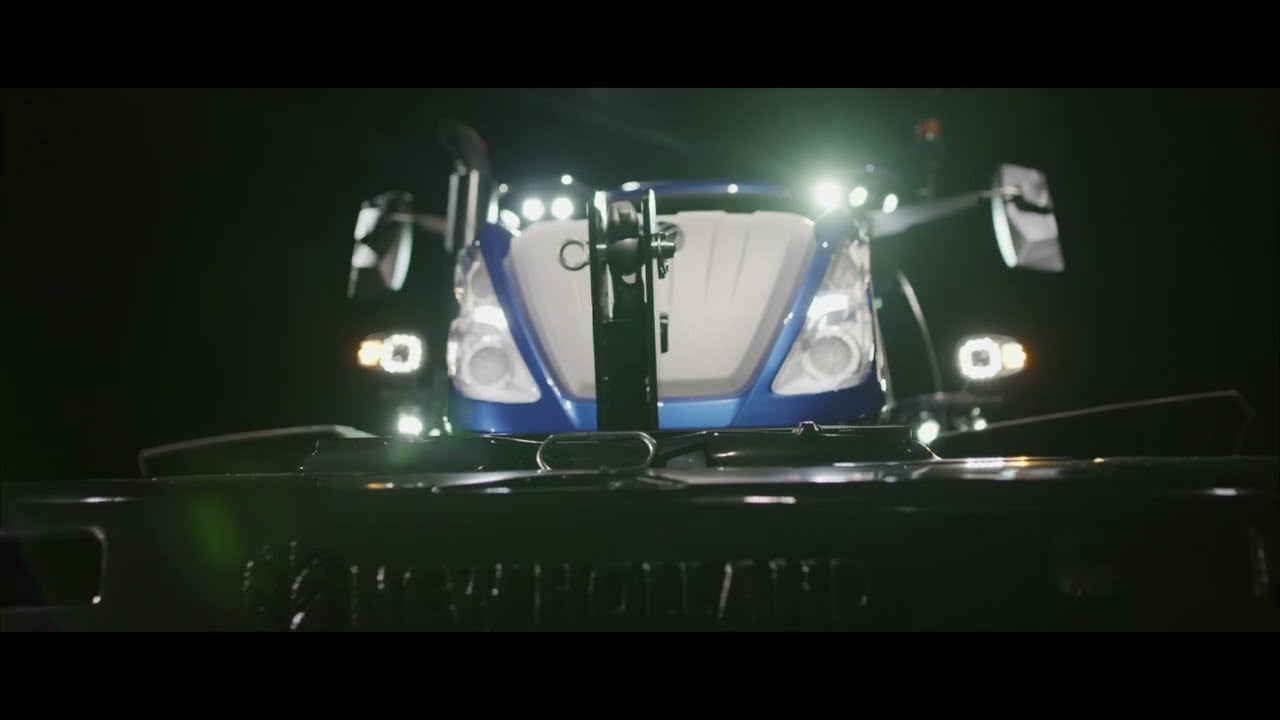

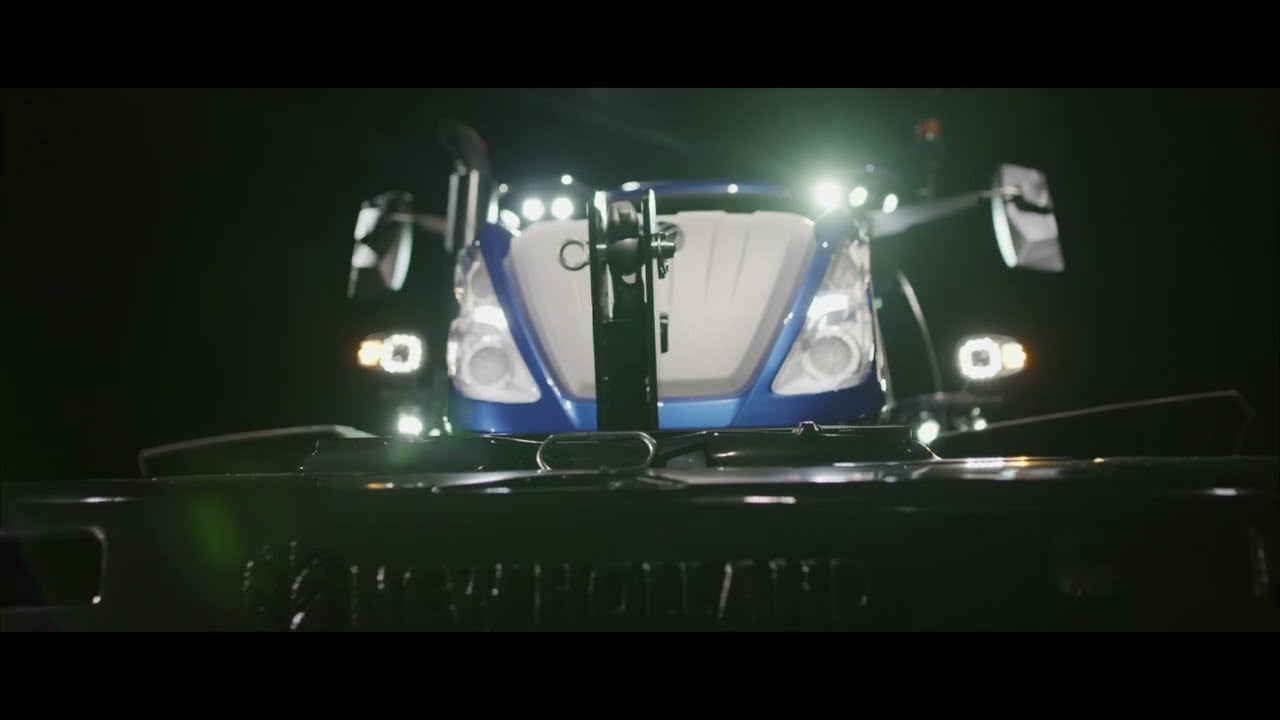

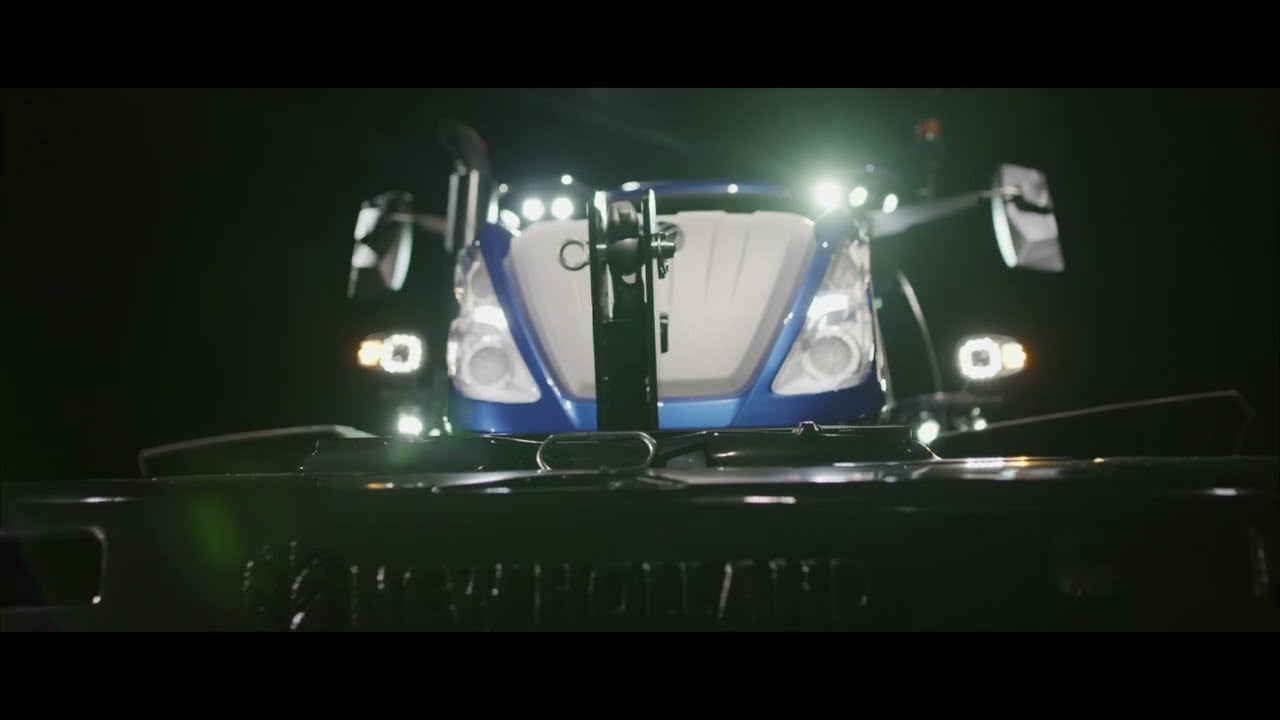

T7.340 HD with PLM Intelligence

The new T7.340 tractor inherits its pedigree styling and key features from the established T7 Heavy Duty range. At 340hp the new model offers more power packaged within the same dimension and weight as the T7.290 and T7.315 models. Bringing in new technology and features pioneered on the recently introduced T7.300 LWB, the T7.340 has impressive characteristics and is the largest tractor in the T7 range.

CR11

More productivity, close to zero losses, better and more efficient residue management and a significant reduction in downtime are the four pillars the New Holland CR11 was projected on, with the overall higher objective to reduce the Total Cost of Harvesting to improve the farmer’s bottom line profitability. Thanks to its 775hp C16 engine, 2x24inch rotors, a graintank of 20.000 liters and a 210l/second unload rate, the CR11 significantly increases productivity to levels that have not been achieved before.

UltraFeed™ grass pick-up on FR Forage Cruiser

A renewed version of New Holland UltraFeed™ grass pick-up on FR Forage Cruiser. Presented in 3.0m, 3.5m and 4.0m working widths, the UltraFeed™ pick-up is designed to enhance crop flow to allow each FR forage harvester model to handle the biggest crop volumes and exploit the full capacity of the large chopping cylinder and the engine that powers it.

T4 Electric Power

New Holland T4 Electric Power tractor combines powerful, emission-free clean energy with cutting-edge autonomous technology – the first in the industry. By harnessing the energy of electricity, you get impressive, clean power with less maintenance, higher uptime, and greater savings without the need for fuel, diesel exhaust fluid (DEF), or engine filters and oil. For maximum productivity and safety, the tractor offers optimal in-cab ergonomics, proven driveline components, and a robust factory-installed loader with cutting-edge autonomous features provided by the revolutionary Smart Roof.

T7.270 Methane Power CNG

True sustainability is possible with New Holland T7.270 Methane Power CNG with PLM Intelligence. It delivers 270hp with the same performance characteristics as a diesel equivalent, but with the additional benefit of lower running costs. Producing 98% less particulate matter, reducing CO2 emissions by 10% and overall emissions by 80%, when using biomethane near-zero CO2 emissions are achievable.

TH Telehandlers Updates

New Holland is introducing multiple updates for its TH Telehandlers, which comprise of five models and 13 variants. Enhancing areas from capacity to comfort, the upgrades are aimed at further boosting customer appeal, and include features that cannot be found from any other manufacturer, such as the EIMA 2022 award-winning electro-hydraulic self-levelling attachment carriage system. Externally, the models are defined by not only by new decals, but also by a lower engine hood profile for enhanced vision to the right.

T7.340 HD with PLM Intelligence

The new T7.340 tractor inherits its pedigree styling and key features from the established T7 Heavy Duty range. At 340hp the new model offers more power packaged within the same dimension and weight as the T7.290 and T7.315 models. Bringing in new technology and features pioneered on the recently introduced T7.300 LWB, the T7.340 has impressive characteristics and is the largest tractor in the T7 range.

CR11

More productivity, close to zero losses, better and more efficient residue management and a significant reduction in downtime are the four pillars the New Holland CR11 was projected on, with the overall higher objective to reduce the Total Cost of Harvesting to improve the farmer’s bottom line profitability. Thanks to its 775hp C16 engine, 2x24inch rotors, a graintank of 20.000 liters and a 210l/second unload rate, the CR11 significantly increases productivity to levels that have not been achieved before.

UltraFeed™ grass pick-up on FR Forage Cruiser

A renewed version of New Holland UltraFeed™ grass pick-up on FR Forage Cruiser. Presented in 3.0m, 3.5m and 4.0m working widths, the UltraFeed™ pick-up is designed to enhance crop flow to allow each FR forage harvester model to handle the biggest crop volumes and exploit the full capacity of the large chopping cylinder and the engine that powers it.

T4 Electric Power

New Holland T4 Electric Power tractor combines powerful, emission-free clean energy with cutting-edge autonomous technology – the first in the industry. By harnessing the energy of electricity, you get impressive, clean power with less maintenance, higher uptime, and greater savings without the need for fuel, diesel exhaust fluid (DEF), or engine filters and oil. For maximum productivity and safety, the tractor offers optimal in-cab ergonomics, proven driveline components, and a robust factory-installed loader with cutting-edge autonomous features provided by the revolutionary Smart Roof.

T7.270 Methane Power CNG

True sustainability is possible with New Holland T7.270 Methane Power CNG with PLM Intelligence. It delivers 270hp with the same performance characteristics as a diesel equivalent, but with the additional benefit of lower running costs. Producing 98% less particulate matter, reducing CO2 emissions by 10% and overall emissions by 80%, when using biomethane near-zero CO2 emissions are achievable.

TH Telehandlers Updates

New Holland is introducing multiple updates for its TH Telehandlers, which comprise of five models and 13 variants. Enhancing areas from capacity to comfort, the upgrades are aimed at further boosting customer appeal, and include features that cannot be found from any other manufacturer, such as the EIMA 2022 award-winning electro-hydraulic self-levelling attachment carriage system. Externally, the models are defined by not only by new decals, but also by a lower engine hood profile for enhanced vision to the right.

T7.340 HD with PLM Intelligence

The new T7.340 tractor inherits its pedigree styling and key features from the established T7 Heavy Duty range. At 340hp the new model offers more power packaged within the same dimension and weight as the T7.290 and T7.315 models. Bringing in new technology and features pioneered on the recently introduced T7.300 LWB, the T7.340 has impressive characteristics and is the largest tractor in the T7 range.

CR11

More productivity, close to zero losses, better and more efficient residue management and a significant reduction in downtime are the four pillars the New Holland CR11 was projected on, with the overall higher objective to reduce the Total Cost of Harvesting to improve the farmer’s bottom line profitability. Thanks to its 775hp C16 engine, 2x24inch rotors, a graintank of 20.000 liters and a 210l/second unload rate, the CR11 significantly increases productivity to levels that have not been achieved before.

UltraFeed™ grass pick-up on FR Forage Cruiser

A renewed version of New Holland UltraFeed™ grass pick-up on FR Forage Cruiser. Presented in 3.0m, 3.5m and 4.0m working widths, the UltraFeed™ pick-up is designed to enhance crop flow to allow each FR forage harvester model to handle the biggest crop volumes and exploit the full capacity of the large chopping cylinder and the engine that powers it.

T4 Electric Power

New Holland T4 Electric Power tractor combines powerful, emission-free clean energy with cutting-edge autonomous technology – the first in the industry. By harnessing the energy of electricity, you get impressive, clean power with less maintenance, higher uptime, and greater savings without the need for fuel, diesel exhaust fluid (DEF), or engine filters and oil. For maximum productivity and safety, the tractor offers optimal in-cab ergonomics, proven driveline components, and a robust factory-installed loader with cutting-edge autonomous features provided by the revolutionary Smart Roof.

T7.270 Methane Power CNG

True sustainability is possible with New Holland T7.270 Methane Power CNG with PLM Intelligence. It delivers 270hp with the same performance characteristics as a diesel equivalent, but with the additional benefit of lower running costs. Producing 98% less particulate matter, reducing CO2 emissions by 10% and overall emissions by 80%, when using biomethane near-zero CO2 emissions are achievable.

TH Telehandlers Updates

New Holland is introducing multiple updates for its TH Telehandlers, which comprise of five models and 13 variants. Enhancing areas from capacity to comfort, the upgrades are aimed at further boosting customer appeal, and include features that cannot be found from any other manufacturer, such as the EIMA 2022 award-winning electro-hydraulic self-levelling attachment carriage system. Externally, the models are defined by not only by new decals, but also by a lower engine hood profile for enhanced vision to the right.

Discover all that we can offer

Special Offers

Special offers won't last, so head on over to your New Holland dealer today!

DISCOVER SPECIAL OFFERSGenuine Parts

New Holland offers an extensive range of parts built specifically for your machines, to satisfy all your needs and for your machines to always perform to their best.

SEE PARTS CATALOGFinancing

Build and grow your business with finance and extended protection solutions from CNH Capital, the preferred lender of New Holland Agriculture.

SEE FINANCING OPTIONS